Profit First

I've paid myself over $3M in after tax profits since starting HostiFi in 2018.

A year ago I implemented Profit First controls into my business. I had been hearing about the concept for some time from people I follow on X, various My First Million Podcast guests, Andrew Wilkinson, people on MoneyWise Podcast and others. When enough smart people mention something, I take note of it. This was one of those things, and I decided to try it out last summer.

It's been great. Not just for the obvious reason of increasing profits, but for other reasons as well which were surprising. It's helped me answer questions like:

- Can I afford to make some new hires?

- Am I paying myself too much and underinvesting in growth?

- Why are we spending so much on OpEx?

But before I get into how I implemented it, how it's been helpful in my business, and the surprisingly useful aspects of it, what is Profit First?

It's a book by Mike Michalowicz.

I never even read it and that's because the title is pretty much all you need to know.

Or is it?

I have heard people say the phrase "pay yourself first" but I didn't understand it and my initial reaction to hearing that was:

- It sounds like selfish and short-term thinking... so just you pay yourself first then if there's not enough left you don't pay your people or your vendors?

- No reinvestment for growth? Rule of 40 says if you're growing 40% per year it's okay if EBITDA is zero, so profit isn't important or can even be foolish when in growth mode.

But digging into it more I learned this isn't what Profit First is prescribing. It helps you plan so you can pay yourself, but also have enough to pay everyone else, and still have a budget to reinvest for growth. We can actually have it all.

If you want to learn the concepts in 15 minutes without reading the book you could watch this YouTube video, but I'll summarize the important points from my experience here and more importantly how I've put it into practice in the real world with practical examples from my own business.

The most important lesson for me was to change the profit equation from

Revenue - Expenses = Profit

to

Revenue - Profit = Expenses

That's it!

If you don't read anything else that's basically all you need to know.

But if you read that equation, understand the math, but still have a disconnect on how that would work for your business, I did too.

So I'll tell you how I went about it.

First, determine your current EBITDA %

The first thing I did is figured out what my current EBITDA % is. I determined that number was about 50% but it could be way higher or way lower for your business, that's not important. It's just important you start this journey where you're currently at and then you can begin improving from there.

Determine what it should be

Then I tried to do some research to figure out what it should be for my industry. For the SaaS industry 20-40% is about where it should be, that's higher than most industries because software is a scalable model with low variable costs. This can be completely different for your industry though, for example, a retail or manufacturing business might be doing great with only 5-10% EBITDA as a goal.

Because I did 50% margin in the past year I was already doing well compared to industry averages, so I decided to keep that number as my goal. But one takeaway from this exercise could be that I'm actually underinvesting in the business and I could be allocating 10-30% more toward growth, if I feel it would be beneficial. I can now justify doing that if I decide to.

If you find out you're below where you should be

Don't worry. This wasn't the case for me but I figured I should mention it for completeness of the guide here. Let's say I was at 10% margin which is below average for SaaS and I determined I wanted to be at 40% which is the high end for my industry. I wouldn't just start paying myself 40% overnight. It's recommended you start with your current baseline of 10%, begin cleaning up expenses and slowly increase your margin about 1% per month or 3% per quarter. So it might take a few years to get from 10% to 40% safely and responsibly.

You don't just start paying yourself the profits you wish you had and leave the business without enough to pay the bills! You slowly cut back and increase the pay to yourself over time until you get to where you want to be, and then you keep it in check from there.

The mechanics of it

Alright so now I knew I was making 50% EBITDA and that was above average for my industry so I wanted to stick with that number. I wanted to begin taking money out of the business each month to pay myself, leaving just enough for the next month of expenses in the business checking account.

I could just check the revenue on the first of each month and then transfer 50% of that number from the business account to Owner's Pay personal checking.

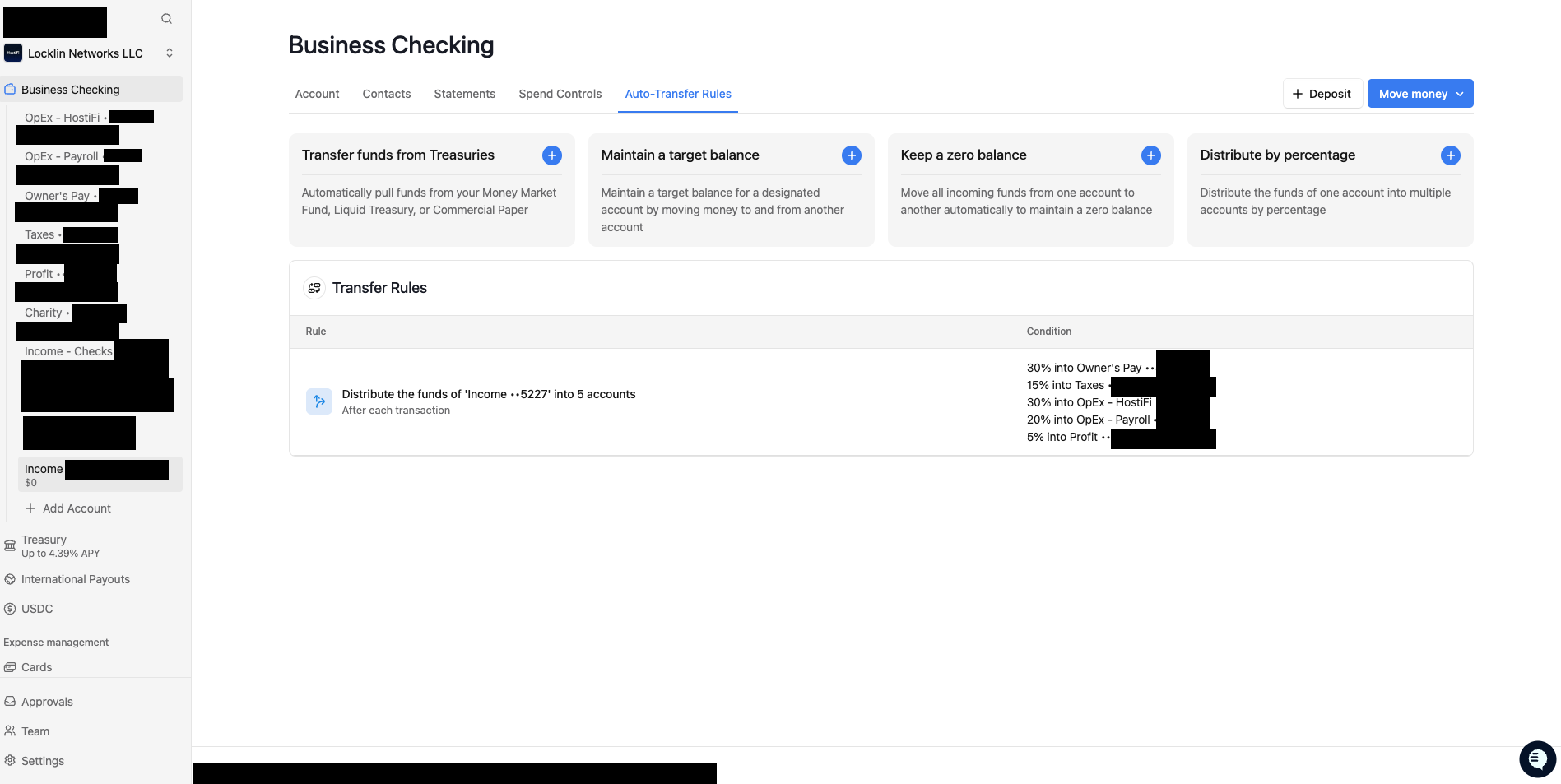

But I decided to go a bit deeper than that, as the book recommends, and create more bank accounts each with their own % of the revenue so I could budget separately for Taxes, Payroll, OpEx, and "Profit".

Profit in this example isn't the same as Owner's Pay, it's actually just extra business money to cover any shortfalls, or the business "fun" account.

I also created a separate personal checking Charity account that I put 10% into from each Owner's Pay transfer.

OpEx is just "all the expenses other than Payroll".

So to visualize that, here are all the separate bank accounts with percentages of revenue going in each month. This is where I ended up for my business.

- 30% Owner's Pay -> 10% of this account goes to Charity account

- 15% Taxes

- 5% Profit (Business emergency/fun money account)

- 30% OpEx

- 20% Payroll

This is not prescriptive, this is what works for my specific business and yours will likely be different.

I know I said 50% EBITDA is the number I chose for my business, so let me explain why only 30% goes to Owner's Pay. That's because Owner's Pay + Taxes + Profit = 50%. The other 50% goes to 20% Payroll and 30% OpEx.

Hopefully that all makes sense.

So start by figuring out the Owner's Pay, Taxes, and Profit allocations for your business first based on your current average.

Then, with what's leftover, determine how much should be allocated to Payroll and Operating Expenses.

Just go with what you're currently allocating, but check industry averages and you can determine if you should make changes in the future.

20% is generally pretty lean for Payroll for example, but that's because the software industry is high margin and a small team has been fine for us. OpEx is higher than Payroll for our particular business because we have a lot of servers we're paying for. Every business is different but industry averages and benchmarks based on your revenue level can be helpful to reference. That combined with your personal experience and good judgement will help you determine where the numbers should be for each.

Figuring out what these numbers should be is the hardest part really.

The implementation

It turns out that creating a bunch of separate checking accounts at Big Bank wasn't possible.

I created the Charity account at different big bank as a second personal checking account.

But for my business checking I moved it to a fintech where I could easily create all the other new bank accounts with the click of a button and configure auto transfer rules to move money between each of them. I'm not going to affiliate link it because I don't want that to detract from my writing here... I don't write on my blog to make money from affiliate links. But feel free to email me rchase@rchase.com if curious and I'll tell you about it.

Side note on fintechs, they're the absolute wild west right now. Don't use one just because I'm doing it. Do your homework. Be prepared to lose everything, even if they claim they're FDIC insured. For me I accepted the risk and because I transfer all the profits out to Big Bank every month I would only be losing 1 month of business expenses. I have plans ready to handle that situation without any business disruption.

But anyways, deposits go into an "Income" checking account at Fintech where they are immediately routed to the other accounts based on the percentages for each. The Income account is always at $0 it's just for routing money out to the other accounts:

It's not perfect but these automations are super helpful for implementing Profit First.

One improvement I hope they'll have in the future is to allow me to zero out the accounts at the first of the month. So for example whatever is leftover in OpEx and Payroll gets moved to Profit. But I can do some things manually like that.

You can do all of this manually too, just create different accounts at different banks and transfer between them manually.

Surprise takeaways

Obviously going into this you expect the takeaway to be increasing profits, but there were a bunch more lessons learned for me that were even more important.

Now I know if I can afford to make that new hire

This is the biggest one for me that's been helpful.

In the early days it was simple - I wanted to make a new hire and I knew I couldn't afford it so I didn't lol!

Then there came a time where I wanted to make a new hire and I could afford it (barely) so I hired.

But then some time around 2022 it got confusing. I wanted to make a new hire, and I could afford to make a new hire, but should I?

Profit First has made this decision easy now. I have my 50% margin established and if I want to make a new hire I check if there's room in the 20% Payroll budget. If not, then the answer is we can't afford to hire yet. Then I can look at the revenue and forecast based on current growth about when we'll be able to afford it.

No more unexpected tax bills

April is a scary month when you have a high growth business. Every April I get a huge tax bill despite paying all of my quarterly estimated taxes on time the previous year. I always paid my taxes, but some years I had to really scrape together the funds to do it.

Now it's not a problem because every time I pay myself I put half of it into the Tax account (30% of revenue to Owner's Pay and 15% of revenue to Taxes means 50% of my take home is set aside for future taxes).

So now I always have the correct tax amount ready no matter how much my income increased from the previous year.

Delegating financial controls

Last year I began to delegate finance related tasks for the first time. For payroll for example, someone else on my team runs it now. Twice a month he logs into our payroll provider, enters bonus amounts for different employees, approves reimbursements, enters hours and overtime hours, stuff like that. And then he's able to hit the button to run it, taking the money out of the Payroll bank account and sending it to the employees.

Before implementing Profit First I never would have felt comfortable doing this because the payroll provider was pulling from the one huge bank account that held all the money for everything.

What if my guy took a big payout and skipped town? Or what if he simply made a mistake but it tied up all the money for weeks while it got sorted out?

Now I can delegate control without worrying about that, the worst thing that can happen is one month of payroll gets wiped and I can transfer more in from another business account or my personal checking if needed to cover it.

Why are we spending so much on OpEx?

For my business I would love to spend more on smart people and less on servers and software. Finding out that 30% of revenue was going to OpEx was eye opening.

How can we reduce that?

It was a ton of work but I was able to cut around $100K/year of expenses in the last few months.

That might be my next blog post.

Thanks for reading

If you've implemented Profit First in your business or have questions feel free to email me, I love to talk with like minded business owners about stuff like this!

rchase@rchase.com