Ramp is not a credit card

I listened to a My First Million Podcast episode today with Sam Parr interviewing Eric Glyman about his experience founding and building Ramp, one of the fastest growing startups in history. It's one of the few to ever reach a $1B valuation and $100M run rate in just under 2 years from incorporation.

What an incredible journey, and it was great to hear the story behind it. He's built an amazing product and business in a very short time.

I'm a customer and a fan...

but I have had both strong positive and negative experiences with Ramp.

I don't think they're going to last long.

This is again, a theme from my last blog post, Profit First:

Fintechs are great, they're bridging tech gaps in traditional banking during this time period in the early 2020s.

But they cannot be trusted.

Fintechs are the Wild West right now

This is hopefully just a moment in time before traditional banks, under pressure from competitors like Ramp, add some basic features like:

- High interest checking accounts

- Remove need for in branch visits, for anything, ever

- Ability to create many different checking accounts at once, easily, online

- Ability to create virtual cards

- Granular control of card limits and employee permissions

- Better UX

We will have Ramp to thank for that when it happens.

And maybe that's too much to ask, but I do think most of these will be implemented by the big banks in the next few years.

I will be the first one to switch back to my Big Bank and be done with Ramp.

Maybe the bigger picture, the contrarian take I have here, is that Big Banks are actually super great and are underrated.

Fintechs are not the future of banking.

Big banks will add the tech and continue to dominate because they're safe bets.

Crypto is not the future of all payments.

The security of a centralized banking system which can do a wire reversal if you made a mistake in the recipient account number is actually a wonderful thing. FDIC is also great.

I don't value features, control, speed, or lower transaction fees more than I value knowing my money is safe.

I am, however, willing to risk some of my money for some benefits, so I will still use fintech banking - but only hold one month of business expenses in it.

Or I'll use Ramp for the ease of use - but keep my credit cards at Big Bank ready to go as a backup.

I don't use crypto at all but if I did, likewise, it would be in small amounts, as needed, for a specific benefit.

All my money is sitting in Big Bank because I know it's actually safe there and will be available when I need to use it.

There are a lot of controls in place at Big Bank which do occasionally add friction in my life, but are worth the security benefit.

Anyways back to Ramp, first let me tell you the good things about Ramp, and then I'll get to those big ugly downsides...

The good things about Ramp

There's only one main thing Ramp does.

Ramp has one killer feature - the ability to create virtual cards.

You can create cards for different vendors, set limits, give employees permission to use cards, and even use an app to swap which virtual card is currently tied to your physical card - which is very cool and works like magic.

Using virtual cards in this way allows me to do all kinds of things as a business owner:

- I can delegate financial control to employees without worrying about it because they only have access to the amount of money they need, and/or can only use it to pay vendors that I've allowed

- I can create a card for a vendor and set a limit on it so I don't have to worry about a vendor making a charge mistake and tying up my money

- I can easily track spending within departments or on specific projects in the business

- I can add or remove employee access instantly without a long banking credit check onboarding process or waiting for a card in the mail

Why hasn't Big Bank done this already?

I have no idea.

At my Big Bank they wanted each of my employees to go through an entire credit screening process before they could get an employee credit card.

Once the employee had the card I had very limited controls over it, and no ability to create multiple virtual cards outside of the one physical card per employee.

Now for the Ramp downsides

They are equally as extreme as the upsides.

As a business owner there are really only two reasons you want to use a credit card, and basically Ramp doesn't help with either.

- Cash flow issues - my business is structured such that we don't have cash flow issues often, we typically collect all money upfront, or at least 50% on big jobs, but the idea is you can buy what you need for a job now and pay for it later after you get paid by your customer.

- Cash back - at HostiFi I'm spending over $1M/year using my business credit cards. If I was using a debit card I would get $0 back for that spend. If I have a 1.5% credit card I would get $15,000/year in cash back. If I have a 2% card I would get $20,000/year. Check with your tax person, but on top of that usually this is tax free money that you can redeem from the business cards directly to your personal checking account.

Let me explain how Ramp doesn't help with either of these issues.

#1 Ramp doesn't help with cash flow issues

They actually found a way to add pain to it.

TLDR when you need them the most because you have a cash flow issue they'll actually notice that and freeze all your cards, adding additional pain when you're already down.

They know when your checking gets low because they make you do a realtime integration from your bank to Ramp and then they continuously monitor your balances.

I learned the hard way that Ramp is not a credit card at all, it's a "charge card".

When I was 18 years old I wanted to buy a house as soon as possible but I didn't have any credit, and knew I would need it. I wanted to get started right away on that.

So I looked into how I can build credit as an 18 year old with no cosigner.

I learned that no one will give you a loan until you have a credit score but you can't get a credit score if you haven't been given a loan.

I decided to start my credit history by "buying" a Secured Visa credit card at my local credit union.

The way it worked was I gave them $1,200 in cash, which I could no longer access until I closed the credit card, and in exchange I was given a credit card with only a $1,000 limit.

This is basically Ramp.

It's more like a Secured Visa than a credit card.

You must have, at all times, more money in your checking account than the Ramp balance.

There is no credit or lending involved.

Good for them, pretty much no risk on their end.

Then you must pay the balance off in full on each scheduled payment, you can't carry anything forward.

Not knowing this ahead of time, you can imagine my surprise when in September 2024 my checking account momentarily dipped below my Ramp balance and all of my cards were frozen.

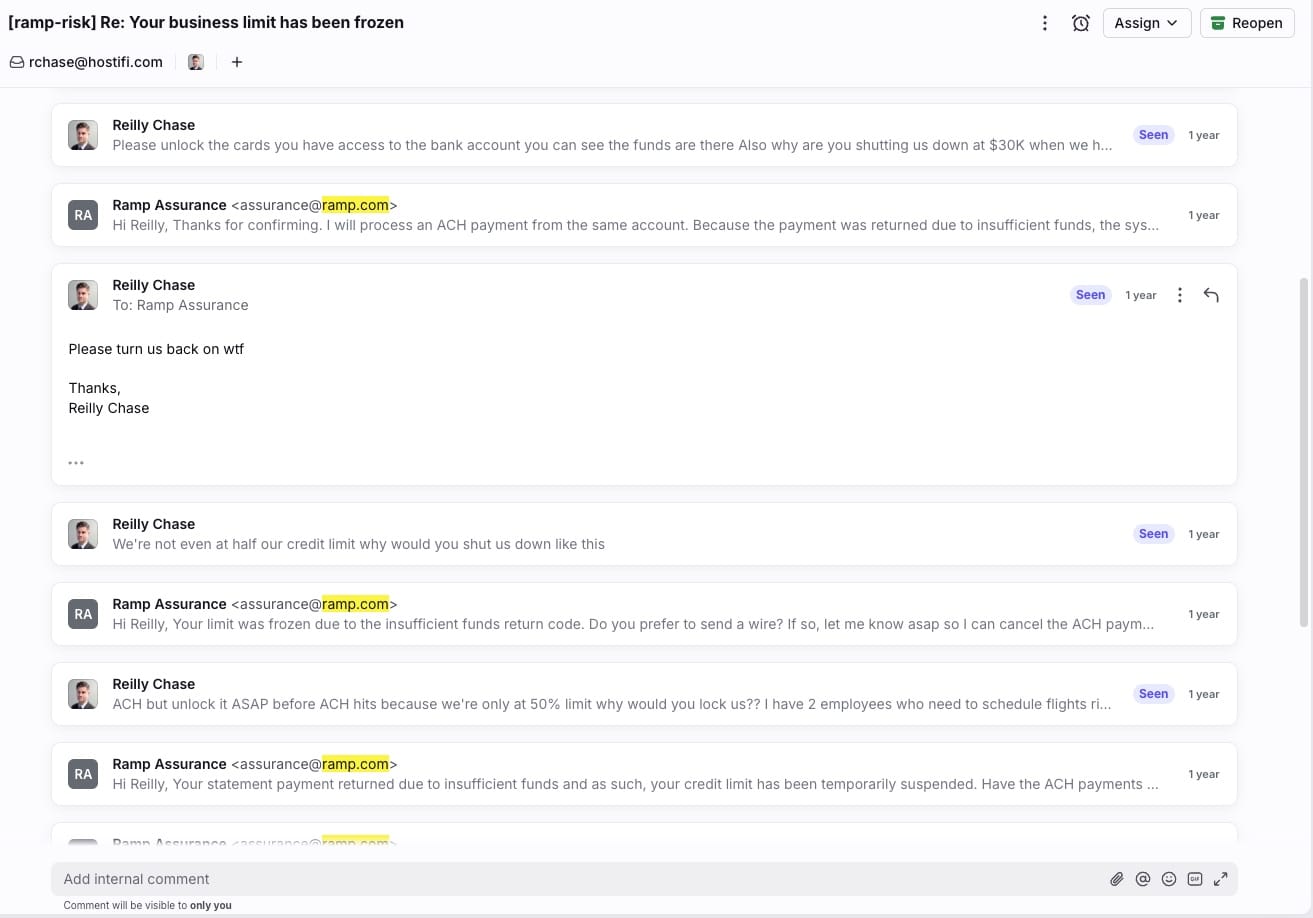

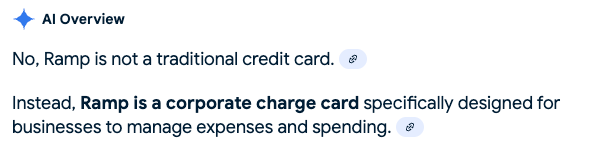

Thus the email chain below.

I had two employees who need to book flights and are unable to, all the payments for my SaaS and critical infrastructure for my business were beginning to bounce, and even my email client was threatening it was going to cut me off if I didn't pay as I hastily typed an email to the Ramp support team:

"Please turn us back on wtf

Thanks,

Reilly Chase"

So lesson learned, now I know, and I have backup plans.

I'll never let this happen again.

Moving on...

#2 Ramp doesn't give any cash back

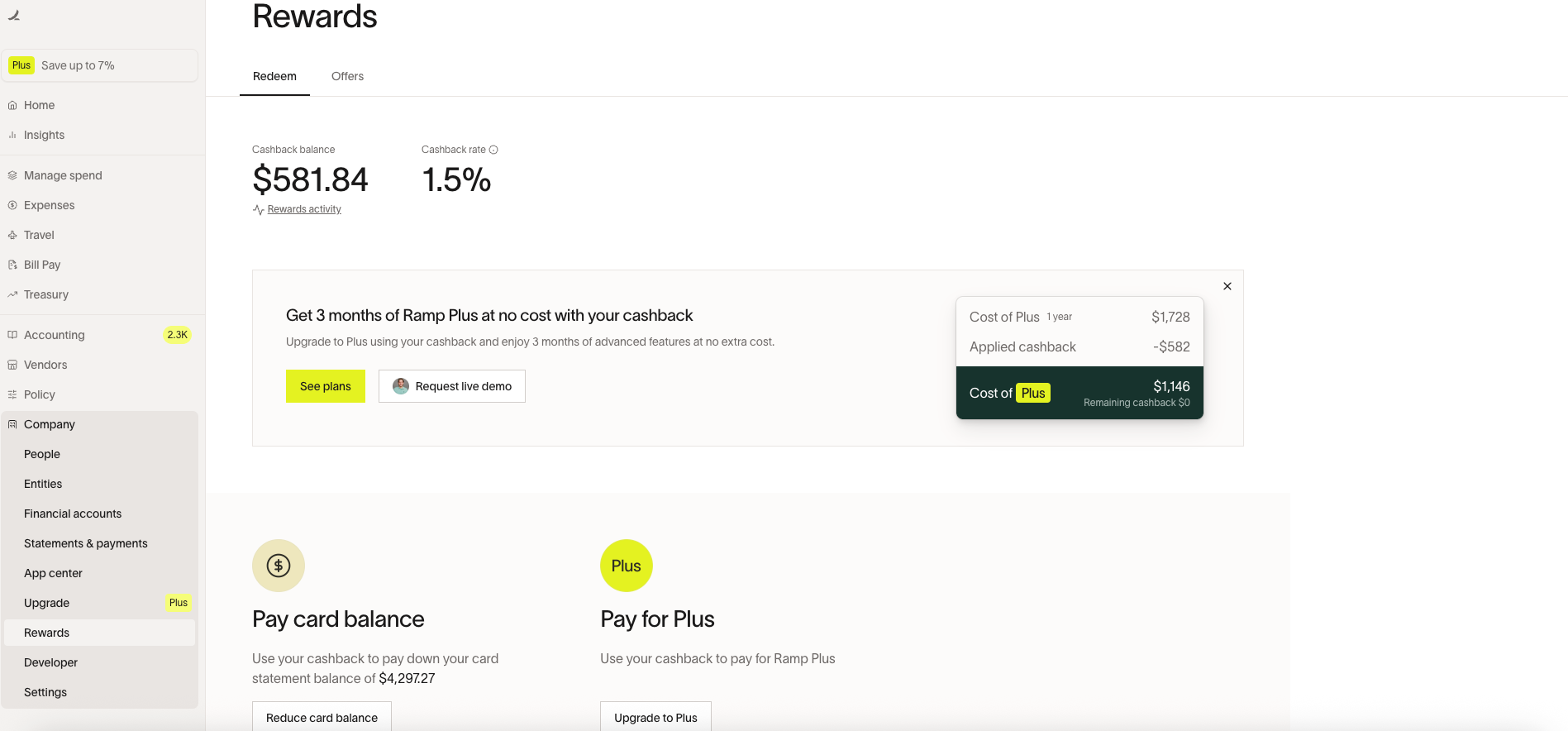

This one is actually so egregious I'm not even sure it's legal what they've done here but they are advertising 1.5% cash back yet only giving basically an "in-store credit" instead of cash.

No one gets any cash back.

You can only use these "credits" to pay down your Ramp balance or buy things from Ramp.

If you're unfamiliar, you might wonder what the difference is between having money deducted from a statement balance versus being given an equal amount of money sent to your personal checking account.

Well it's actually big. Like I said before, check with your tax person, but from my understanding, cash back is not taxable in the state of Michigan or the United States.

So I'm getting about 40-50% less cash back doing it Ramp's statement balance credit way than I would get at Big Bank by withdrawing cash back into personal checking.

It's a big difference.

Also getting 1.5% cash back when you're doing $1M/year spending is not a good rate at all.

That's what any normal person can get on any basic credit card.

When you're spending this much money the Big Banks will do much more for you.

And even a tiny .05% cash back increase at this spend level is over $5K per year tax free money, it adds up.

It's a love hate with Ramp but I'm still with them, for now

Here's why:

- They really nailed the features and the UX

So much so that I'm willing to:

- Pay a $32,500/year "subscription" due (lost cash back)

- Risk having to drop everything and update my credit card info for over 50+ vendors at a moments notice because I get my cards frozen by Ramp for no reason

The math behind the Ramp "subscription" fee for those curious:

- $1M/year spend x 4% cash back at Big Bank = $40,000/year tax free

- $1M/year spend x 1.5% at "cash back" at Ramp = $15,000/year - taxes = $7,500/year

- $40,000/year - $7,500/year = $32,500/year cash back lost - my Ramp "subscription" dues

I have moved my biggest vendor payments off of Ramp cards back to Big Bank cards for the cash flow, cash back, and trust reasons.

I only use Ramp now for employee related cards or cards I want to track spending on for departments.

If Big Bank will implement even a small feature set of what Ramp has I'll be back.

But maybe that will never happen and Ramp will just keep crushing it for a long time to come.

Regardless, the Ramp founders already made their money and put a big dent in the industry, they accomplished a ton and pushed everything forward into the future.

They deserve all the respect for that.