Investing

This post is about my journey as an investor.

For everyone who commented "You need to put that it's not financial advice in your posts! Investing has risks!"

Here's for you - This is financial advice. Sue me.

I went from no-investing, to day trading, to 401K'ing, to losing $108K in a scam, to real estate, to index funds...

And now I don't do any of that, all I own is 4 stocks that I plan to hold 5+ years.

I'll never own more than 5 stocks at a time.

Very undiversified.

And the stocks I bought were all at really big lows with big risks ahead for the businesses... at least that was or is the market consensus.

But after I did a lot of study for each, listened to every founder/CEO interview I could find, tried to understand the financials, and trusting in my own experience with their products, I decided I disagreed with the investor consensus, so I placed big bets.

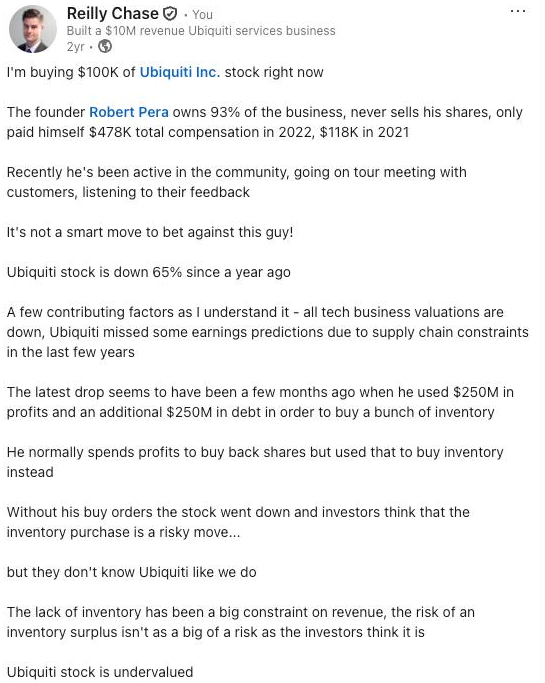

The four stocks right now and my split between them are:

25% $UI

25% $MCW

25% $RIVN

25% $VTI

$MCW I bought 5 months ago at $5.41/share and today they announced it was being taken private at $7/share so my shares unfortunately will be bought back in a few months but still +30%.

$RIVN is my new investment yesterday.

I'm giving some context and background in this post before I write some future posts on why I made each of these investments.

I write about this to keep myself accountable - whether I'm right or wrong, in the future people who read this will know.

But more importantly these posts attract input from other investors. They bring me arguments and ideas that strengthen or challenge my own. It's important to learn as much as I can to better understand the risks and potentials of the investments I'm making because I have a lot into it.

I found my way to this strange approach of putting everything into a few stocks instead of diversifying by reading and listening to Warren Buffet "The Warren Buffet Way", Charlie Munger "The Tao of Charlie Munger", and Howard Marks "The Most Important Thing" among others.

It's not for everyone, I'm not saying you should do this.

A couple of unconventional thoughts upfront.

• Investing doesn't make people rich, it keeps money safe from inflation.

• Don't start investing when young. Spend everything on education in early 20s instead. I invested in myself first, funding college, certifications, and side hustles to increase my future earning potential before thinking about investments.

• Never work with a financial advisor. No matter how smart or honest they are, the incentives aren't aligned, most underperform the market, the % of AUM model is bad model, I won't abdicate management of my hard earned money... I could go on.

• Don't 401K. It locks up the money until old age, and lets the finance people chip away at it with their fees. Nope. It's my money and I might need it. It's better to pay those taxes and buy an ETF index like $VTI or $VOO. Keep control.

• Don't skip coffee and going out to eat to be a millionaire when at age 65. A million dollars will be nothing then anyways and I might be dead. I invest in leveling up skills to make more money instead.

• Diversification = diWORSEification.

"I have two views on diversification. If you are a professional and have confidence, then I would advocate lots of concentration. For everyone else, if it’s not your game, participate in total diversification... That’s what most people should do, buy a cheap index fund and slowly dollar cost average into it." -Warren Buffet

Because my business began to pile up profits in 2020 and 2021, during some of the highest inflation in history, I was forced to learn how to invest just in order to not lose the cash value sitting in my account.

And I made a lot of mistakes along the way.

This is just my path.

Everyone has different risk tolerances, skills to bring to investing, and interests.

You have to find what works for you, make your own path, and your own investment decisions.

Maybe sharing my story will be useful for others.

Not investing

From 2011 to 2020, with incomes ranging from $25,000/year to $100,000/year I bought cars, paid my rent, spent money on education, funded business side quests, and lost $15K "day trading" a Chinese oil stock. I didn't know anything about investing.

401K investing

I started putting a small amount of my paycheck into a 401K in my early twenties.

By the time I was 25 years old I had about $30K in it.

I needed $20K to put down on my first house, but I couldn't use my 401K for that.

Technically it's possible?

But probably slow and with a bunch of strings attached.

So this was my first bad experience with the 401K locking up my money.

My next experience with my 401K was when I needed money to live off of while I was going full-time on HostiFi in 2019.

I tried to read the financial statements and couldn't understand them, they didn't make it clear how much money was gained/lost in the investments.

I finally mathed out that the 401K was worth less than the sum I put into it... during the greatest bull market in history my 401K lost money.

I cashed it out and paid all the fees which added up to about 30%. I was done with 401K.

An important personal value for me is autonomy. I have to have control. And 401K is not that.

Real estate investing

Buying houses

I bought my first house in 2018, my first "investment", which I sold 6 months later, barely breaking even, after I was fired from my job and decided to go all-in on HostiFi. My fiance and I moved in with her parents.

In 2020 I had built up some profits from the business. The first thing on my mind was getting back into our own place. The house across the street was foreclosed on by a bank and listed on auction.com for $60K. I was the only bidder and bought it cash, my second investment. We put $20K into it - new appliances, water heater, paint, flooring, carpet, gravel driveway.

It was probably worth $120K after we had done that, so we had "made" $40K off of an $80K investment in a few months.

This was a great example of what good investing is.

It's not some passive thing where money makes money.

We took this sketchy situation, we risked our money to buy a bank foreclosure on a website "AS-IS" with no photos and no home inspection.

We came in and the place was trashed and pillaged.

We fixed it up and created more value than we put into it.

But we took that risk because we knew something other people didn't.

We saw the house, it was across the street. We knew the people who lived there. We knew the whole story. We knew what to expect.

After they moved out and before I bought it I walked in, the door was unlocked, and I looked around to know what I was getting into. There was a risk/reward doing that.

Risk of getting charged for trespassing: low/non-existent.

Risk of losing my money because I didn't see the inside of this house before I bought it: high.

Not something I would normally do, but this was a special/edge case situation.

After seeing the inside I knew what it was going to cost to fix it up and what I'd be willing to pay for it, knowing the work that was needed.

How it relates to the stock investing I do now is it's finding a mispriced asset because there's a legitimate big risk involved, but other people are overly fearful about that risk and I understand it better.

Not because I'm smarter than everyone else, but because I put more time and effort into understanding that risk.

But this was my primary residence, not a rental.

It happened to ROI but I still didn't really know how to invest.

Two triplexes

My first idea was to repeat what I did with my house but then rent it out. I listened to the BiggerPockets podcast a lot during that time. In particular I wanted to do the BRRR method: Buy, Rehab, Refinance, Repeat.

I looked at buying 2 triplexes in spring of 2021. The seller claimed the units were all rented out at $600-$700 each and asked for $370K. I offered $320K. She agreed. Then I went to do the inspection...

During the inspection I talked to the tenants and found out:

- She never did any maintenance, lots of unfixed problems with rigged solutions that were done by one of the tenants for a rent discount.

- She increased rent on everyone before listing in order to get a higher list price and the tenants told me they couldn't afford it.

- One of the units hadn't been rented in 6 months but the previous tenant still had the key and the other tenants said she would still stay the night there sometimes.

- One tenant had music blaring and the smell of weed coming out of the apartment. I guess he thought we were the cops because he wouldn't open the door when I knocked. The next thing I know he jumps off the second story balcony and takes off. I don't make this stuff up.

I didn't trust the seller or the real estate agent she had.

I can deal with problems - fixing problems is how value is created.

But I can't do deals with dishonest people. I was out.

She ended up selling the triplexes for $340K and today the Zestimate is $536K.

I don't have any regrets. I'm glad I spent the time and money trying to buy those triplexes because I realized a few things for myself.

I learned real estate wasn't for me.

Real estate isn't passive income, it's a business.

I would need to find the best deals - that takes sales and marketing. Simply bidding on already listed places means competition.

Sending mail and making phone calls to be able to make offers before properties are listed is the best way to find deals.

I would have to invest time and money to fix problems in order to create value.

Especially in the beginning I can't just delegate and hire property managers because I don't have scale and can't afford it.

But I already had a business.

And it was growing fast.

With HostiFi, I had a better, more scalable business than real estate.

It didn't make sense to split my attention into a smaller slower business.

I also had nothing to offer in terms of the skillsets needed for real estate.

Ideally I'd be someone who is very good with numbers because real estate is a spreadsheet game. Sticking to budgets for maintenance. Not improving a property more than it can rent for. That's not me.

I have barely any skills around the house as a handyman, much less as a trades contractor or general manager. Yes I could try to learn but why?

I already have a very different, but also valuable, skillset.

I was done with my real estate dreams but profits from my business continued to add up during one of the highest inflation periods in history.

I needed to invest somewhere because the cash was losing value.

Real estate as a store of value

As a side note I like real estate as a store of value. An illiquid asset. I can't be accidentally wired to someone. It can't be lost in a bad business deal. It doesn't typically swing up and down in value.

It barely beats inflation for most locations in the US, with averages of 3-5% appreciation, but it generally holds its value over time.

It's a big loss for money that could be compounding but a win for sleeping easy at night.

Getting scammed

Summer 2021 I took the biggest financial loss of my life. I gave Dashel Lathers a $108K loan which was supposed to be paid back quickly with a lot of interest. I never received any of it back.

That's a long story but TLDR he was a HostiFi customer and we had built trust up over a long time period before this.

I had given him a small loan before which he had paid me back for.

The money was supposed to be used to purchase IT equipment upfront for a customer of his business and paid back after the customer paid him.

It turned out, despite my minimal due diligence by verifying over video call it was him asking for the money, having him send me the bill of materials and receipts of equipment purchases, it was all a made up story.

He was a fraud who scammed dozens of people. He ended up getting arrested the following year and did prison time in Texas for a different scam.

Index fund investing

After this experience getting scammed, I finally learned how to invest in the stock market.

I had avoided this path because of my bad experiences losing money day trading and with the 401K locking my money up when I needed it.

I had assumptions about the stock market which I no longer believe - for example I thought I had to be a math expert, or be smarter than everyone else, because everyone has the same information so there's no edge.

But then I learned that I can buy $VTI, a stock which is an index of 4,000 US public companies which tracks the overall market. I could buy or sell it at any time without the 401K withdrawal fees, the only difference being I had to pay taxes before investing.

I always heard diversity is a good thing in investing so it seemed logical, and it is one of the safest investments out there balancing risk and return.

• The overall US stock market grew on average 10% over the last 30 years, inflation averaged 3% during that time so 7% per year true growth.

• "Retirement" = the 3% rule. If you live off of 3% of your invested money you'll never run out. 3% inflation +3% draw = still average 4% growth per year with never touching the principal amount. Divide the number you need to live off of by .03 to get the number you need to have invested in the stock market to never need to work again.

Buying $VTI was a truly passive income. I was able to stay focused on growing my business, without my cash losing value over time, and $VTI went up about 60% in the last 5 years.

I didn't get a 60% return because I was making weekly auto investments, not all at once, but it still has been a great return for me.

Investing in my own business

Something that stuck with me after reading "The Warren Buffet Way" and "The Tao of Charlie Munger" is that a good operator returns money to shareholders when they're unable to beat the average stock market return for that year.

A metric of a good business isn't its growth rate alone, but its growth rate relative to the overall market that year.

For example a bad operator takes the profits and puts them back into the business, helping to grow it 10%, while the market overall grew 30% in the same year. The money would have been better returned to shareholders and invested in $VTI in that case.

It's tricky because it's not exactly easy to know or measure the outcome of investments in the business - but I try to think about this now. Whereas before I had never even considered the idea.

Acquisitions as a store of value

I've acquired two businesses and merged them both into HostiFi. One for $250K and another for $160K. I'm looking at doing another acquisition and merge this year. These have been my biggest investments in the business outside of the necessary team growth and expenses.

I've never invested money into sales, ads, or marketing for growth, not because I'm above it, but because I haven't figured out how to get more out than I put in yet.

I used to think about the acquisitions in terms of multiple arbitrage. If I buy MRR for 2X but because my business is bigger that same MRR could be sold for 4X then I've instantly made my money back in equity.

But a few years ago I decided to never sell HostiFi.

So for new acquisitions I look at cash flow, time to ROI, and cross-sell potential to existing customers to add value to the investment. When I run the numbers it needs to be a better investment than putting the money to work in the stock market. Again not always an easy calculation but it's something I try to think about.

One of the benefits of acquisitions though is thinking of it as a store of value like the real estate holdings. It's illiquid, it doesn't fluctuate in value very much. With it locked up I can't lose it easily doing something dumb.

Individual longterm stock picks

"This just in: You can’t take the same actions as everyone else and expect to outperform." -Howard Marks

I used to 100% believe the idea that no one can beat the stock market by picking stocks because everyone has access to the same information, only insiders and genius mathematicians can win, or only exceptionally talented people like Warren Buffet can consistently beat the average returns of the overall market.

It's true most people don't beat the market and are better off in $VTI.

But slowly as I listened to people like Howard Marks and read his book I came around to the idea of picking stocks. Only 5 or less because that's the max amount I can stay up on all the details for. The idea is to research these stocks in depth and holding them for 5+ years or forever as long as my belief in the company stayed the same.

Even if I don't beat the market, I'm hoping to minimize my downside risk by investing in businesses that I understand well.

And I'm also building the skill of investing.

By doing this I'm forcing myself to better understand public companies, read financials, talk to other investors, and watch interviews with founders that I'm personally interested in.

In theory this is going to inspire me, give new insights, connect with interesting people, and help level up in my journey with my own business.

Warren Buffet says "I'm a better investor because I'm a businessman, and a better businessman because I'm an investor."

I'm planning to write detailed blog posts on why I made each investment but wanted to write this one first for context on my journey into investing.

My criteria for picking a stock:

• The founder is the CEO and has significant ownership/stake in the results

• The business model is easy to understand

• The stock is down a lot because of investor fears that I understand and disagree with the seriousness of longterm for the business

• I personally use the products and love the brand

• Max 3-5 because I can't possibly keep up with consuming all the available content if I do more

After looking at 4,000 US publicly traded companies I wrote down about 100 that I've at least heard of or been a customer of in the past.

Then I narrowed that down to a very short list of companies I love.

Then I narrowed that down even further to companies where the stock is down a lot for a reason I disagree with longterm.

This is how I came up with only 3 stocks to invest in.

Conclusion

You have to find what's right for you.

Real estate was not for me because I bring no value - I'm not a handyman, I'm not a spreadsheet guy, I can do sales and marketing but I'm too busy with a better business that I already have and is growing.

Day trading was not for me because I tried it out a few times and I didn't have the discipline to watch the market open in the morning and plan trades the night before, it's more like a job and I don't love the grind of the type work itself.

401K is not for me because a core personal value is autonomy.

Business acquisitions for me are a tricky one, I'm not sure I'm able to beat the stock market doing it but I enjoy it, it's a store of value, and I can at least bring some value to grow it unlike with real estate. I'm also learning and building this skillset which can be useful in the future.

My primary investments going forward are going to be 5 companies or less that I personally use the products, enjoy reading the quarterly reports, believe in the management team, hold for 5+ years, low perceived downside, mispriced due to overblown investor fears, and I have strong conviction on longterm.

For most people I would recommend just sticking with an ETF of the indexes - $VTI or $VOO.

FYI If you reply to this post it goes straight to me now... I fixed that.

If you're reading on the website you can email me at rchase@rchase.com.

It would be great to hear your thoughts!