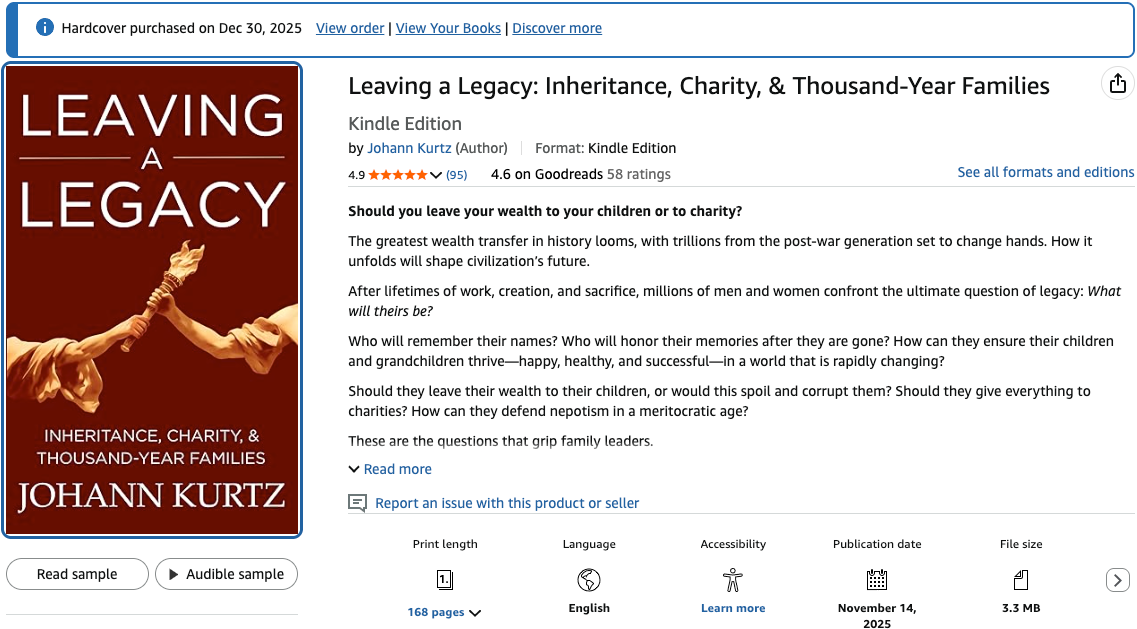

Leaving a Legacy

Inheritance, Charity, & Thousand-Year Families

I just finished reading this book and it answered so many questions I've had about inheritance and charity that I want to write some of it down as a reminder to my future self and blueprint for this area of my life.

Regarding Inheritance

Meritocracy

The book was critical of the modern ideal of meritocracy.

My feelings before about this were somewhat like the following

Outwardly I acknowledged the role of luck, my upbringing or privilege, and my God given abilities.

But was I honest?

Inwardly I mostly felt that I earned what I have.

I worked hard.

I worked smart.

I outran my competitors.

I "increased my luck surface".

I made sacrifices others didn't to get where I am.

The older I get, and the more life experience I have, the more I am legitimately humbled, and grateful.

But this book really 10Xd that mindset shift for me.

I don't know if the book even stated this directly, but I came away with a feeling that

I have been given everything I have, nothing is mine, it's God's.

I have been given not just a blessing, but a great duty and responsibility.

I feel this deeply now.

How does this tie back into the topic of inheritance?

My feelings about inheritance before reading this book

I earned mine, therefore my kids must earn theirs.

I should give very little or nothing to them to make sure they have solid work ethic.

If I give too much to my kids they'll be spoiled, lazy, and won't know hard work.

Now my feelings are

Like them, I didn't earn it, I was given it, and I don't own it. It is God's.

It's my duty to be a good steward of the wealth, increase it, and use it to help others. Their duty is the same as mine.

The next generation can be good people, hard working, and raised in this mindset if I lead well as a father.

I had previously subscribed to the idea that my wealth will be destroyed by the third generation.

There is a saying that the first generation makes the money, the second keeps it safe, the third blows it.

Now I know it doesn't have to be this way.

Regarding Charity

For context I've been putting aside 10% of my after-tax income into a separate charity bank/investment account starting last year when I began keeping better track of HostiFi finances.

As this account has grown, the burden of how and when to use it has too.

Initially I considered creating my own non-profit to shield it from taxes and allow it to compound faster while it stayed invested before I figured out what to do with it.

But there were too many restrictions around that, and I wanted to be able to give to whoever I want, whenever I want, for whatever reason.

So I decided to let it be taxed.

The first question that the book answered for me was regarding the idea of whether the money was best used in my lifetime or if I should optimize for maximum impact by letting the investment compound.

In answering this question the author talked about the meaning of charity in the context of the good samaritan parable in Luke 10:25-37.

25 On one occasion an expert in the law stood up to test Jesus. “Teacher,” he asked, “what must I do to inherit eternal life?”

26 “What is written in the Law?” he replied. “How do you read it?”

27 He answered, “‘Love the Lord your God with all your heart and with all your soul and with all your strength and with all your mind; and, ‘Love your neighbor as yourself.”

28 “You have answered correctly,” Jesus replied. “Do this and you will live.”

29 But he wanted to justify himself, so he asked Jesus, “And who is my neighbor?”

30 In reply Jesus said: “A man was going down from Jerusalem to Jericho, when he was attacked by robbers. They stripped him of his clothes, beat him and went away, leaving him half dead. 31 A priest happened to be going down the same road, and when he saw the man, he passed by on the other side. 32 So too, a Levite, when he came to the place and saw him, passed by on the other side. 33 But a Samaritan, as he traveled, came where the man was; and when he saw him, he took pity on him. 34 He went to him and bandaged his wounds, pouring on oil and wine. Then he put the man on his own donkey, brought him to an inn and took care of him. 35 The next day he took out two denarii and gave them to the innkeeper. ‘Look after him,’ he said, ‘and when I return, I will reimburse you for any extra expense you may have.’

36 “Which of these three do you think was a neighbor to the man who fell into the hands of robbers?”

37 The expert in the law replied, “The one who had mercy on him.”

Jesus told him, “Go and do likewise.”

His argument was that charity should be personal, local acts of love, toward neighbors, involving more than just money.

In the parable the Samaritan helps a local man, in person, using his time and money. The Samaritan didn't give his money to an institution to help people on his behalf who he's never met, who live in a faraway land.

I was beginning to come to this realization on my own when I decided not to create my own non-profit in favor of giving to individual people in my life, but felt the book and the parable reinforced it for me.

This answered my question of whether to invest it for my lifetime or spend it. Charity is an act for me to do in my lifetime. Putting it off for someone to handle after I die is avoiding my duty to my neighbor.

Regarding Thousand-Year Families

The book made me realize the main thing I don't want is for the next generation to kick back living off of the mutual fund.

Previously I thought this was the goal for me, and the next generation shouldn't have it because it would corrupt them without experiencing the struggle I did to get it.

Now I realize this shouldn't be the goal for any generation including mine.

I already came to this understanding in the past two years.

When I surpassed the "end goal/retirement" net worth number I had set when I started my business in 2018 I felt depression and a lack of purpose.

Simply increasing the financial goal in my life felt artificial and meaningless

Reframing wealth as a gift and a duty, a legacy to create and pass to my future generations for good use and to multiply feels like the purpose I needed in my life.

The key to succession over the generations is that the family needs to gradually pass down responsibilities, management of the estate, and eventually illiquid assets like land and businesses in the end rather than mutual funds.

Succession starts in young adulthood

It can't be handed over all at once at the very end after death.

In this way the family fortune is earned over time by the next generation as a reward for diligent management of smaller family assets. This builds the skills and work ethic required for managing the larger estate.

It can also be implied that wayward descendants won't be subsidized and risk being disinherited entirely.

For the young adults joining the family business, unlike working at a job where they're building wealth and assets for their employer, the work they'll be doing in the family business they'll eventually inherit.

If they spend their careers outside the family business they'll develop relationships, loyalties, and knowledge that probably won't be helpful to running the business when I'm ready to retire and pass it down.

If the kids go into "normal" jobs like doctors, lawyers, or consultants, when they inherit the business they'll sell it and then retire off of mutual fund investments.

If they do that, they may lack purpose which can lead to a life of hedonism and wealth destruction.

If the kids don't want to work in the family business, encourage them in other entrepreneurial pursuits that way they'll still have something to put the family assets to work when they inherit.

One of my biggest questions for succession planning has been

"How would I ever pass down a complicated, fast changing, highly competitive business like HostiFi?"

"What are the chances HostiFi exists in 10 years, much less 100 or 1,000? What could that even look like?"

I felt like the book was speaking directly to me when the author wrote

The author recommends transitioning risky assets like HostiFi to be a minority of the family portfolio before handing it down to the next generation.

This has a few added benefits

• The children inheriting won't feel as overshadowed if we're both going into a new business rather than handing off a business that I've been running for 40 years

• Businesses that are relatively straightforward to manage and scale are resilient to inevitable fluctuations in generational competence

Example of types of businesses that can can last generations

• Management and leasing of agricultural, commercial and residential properties

Types of businesses to avoid passing down

• Highly volatile industries, heightened competitive pressures, likely to face technological change

Conclusion

Great book, opened my mind to a lot of possibilities, made me feel a greater sense of purpose in my life, and at the same time less anxiety about the shame and guilt that I felt with financial success.